At SurveyPocket it’s our goal to create the best mobile research and data collection app in the market. Traditional field methods to collect qualitative and VOC research require people to write comments in or have field researchers carry extra equipment to capture photos or videos, then spending time to cross-reference which comments/pictures go with which survey. With SurveyPocket, you can enhance the mobile field research experience by allowing field researchers and respondents to take pictures and record video clips while collecting survey data.

Instead of forcing a respondent to write a comment, field researchers can now record what respondents are saying right on the spot, or take pictures of what’s happening while the data collection is in process. When was the last time your paper and pen took a picture and video while collecting respondent data?

Ummmm, Never!

As a researcher, what’s more insightful? Reading a bunch of comments on a spreadsheet or watching a series of respondent videos comments? For me, I’d make some popcorn, have my laptop ready to take notes, and watch the videos and note the facial reactions, vocal tones, and hear what they really want to say straight from their mouths.

No doubt, this is a game-changer in the way research and data collection is conducted in the field! And if you haven’t jumped on the board with SurveyPocket then you are missing out on great data collection opportunities that a pen and paper cannot capture. Your field team can never remember all the details of their interaction with field respondents. Recording and photos will liven up any field project to your data-driven project.

How long does it take to set up video and image capturing question types to use on the SurveyPocket App?

It takes 5 simple steps to set up an image/video in your field survey.

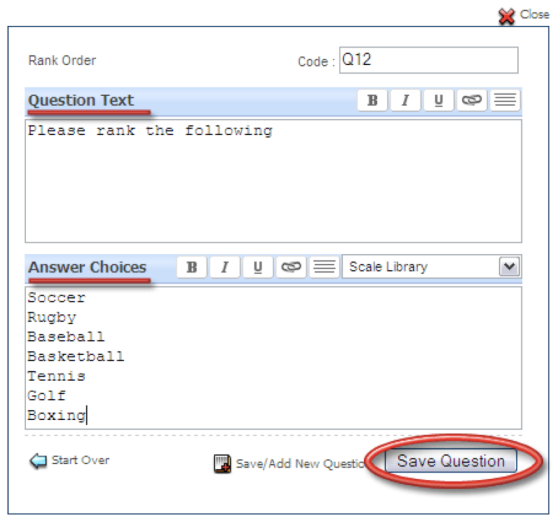

Step 1: To add an image or video capture question go to:

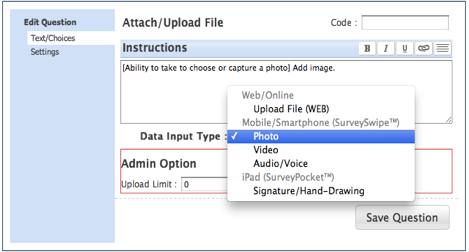

Attach/Upload File -> Click on Data Input Type: Choose either Photo or Video

Step 2: Add Instructions for the video or photo

Step 3: Complete the rest of your survey and make sure to your survey is assigned a device key from the Mobile tab.

Step 4: Pull up the SurveyPocket App, add the device key, and click on the synchronize button to pull up the survey to begin fielding.

Step 5: Follow instructions to capture image. You can take more and 1 image if needed that time and also move, rescale, or retake a picture if needed.

Example of picture taken on the iPad while taking the survey:

Here is a fun example of Video Capture question done on the iPad 2 using SurveyPocket. I was at the annual Fremont Solstice Festival in Seattle, WA this past June and took a few pictures of what was featured during the parade with the iPad.

I then proceeded to interview a couple next to me and asked them what they liked about the Fremont Parade this year. Click on their picture I took of them with SurveyPocket to hear what they enjoyed about this year’s parade.

How can I access the pictures and videos captured in the field with SurveyPocket?

Go to:

Login » Surveys » Reports » Data Management » Response Viewer

Search the database and click on the Response ID link to open up the individual responses. You can go to the Upload/Attach question and download the file from the link provided. Click on the respondent ID to pull up the link to view photos or video.

To learn more on how to use SurveyPocket for field research or data collection, or to set up a free trial demo of SurveyPocket go to http://www.surveypocket.com or click on the logo below to view & download SurveyPocket to your iPad today!

Survey Analytics’ Executive VP (and self-proclaimed old guy) has a fantastic article on Research Access that talks about

Survey Analytics’ Executive VP (and self-proclaimed old guy) has a fantastic article on Research Access that talks about  HubSpot, the gurus of inbound marketing, ran an article this week that outlined 5 reasons for mobile marketing. After looking at their reasons for jumping into the mobile marketing pool, I was inspired to come up with some reasons or applications of my own.

HubSpot, the gurus of inbound marketing, ran an article this week that outlined 5 reasons for mobile marketing. After looking at their reasons for jumping into the mobile marketing pool, I was inspired to come up with some reasons or applications of my own.